Top 33 Aerospace & Space Venture Capital Firms in 2024 Ad

Description

CTA Are you a founder building a startup in the Aerospace & Space industry?

Whether you’re still in the early stages of your entrepreneur journey or you’ve already found product-market fit and are ready to scale your company, I think you’ll find useful this list of venture capital firms investing in your industry.

33 Aerospace & Space Venture Capital Firms Tool

Fundraising OS

Everything you need to raise funding for your startup, including 3,500+ investors, 7 tools, 18 templates and 3 learning resources.

Buy It For $97 $297 → Sheet

1,000 VC Firms

Information about the countries, cities, stages, and industries they invest in, as well as their contact details.

Get the Sheet for $50 Sheet

250 AI Investors

List of 250 startup investors in the AI and Machine Learning industries, along with their Twitter, LinkedIn, and email addresses.

Get the Sheet for $50 Sheet

250 BioTech & Health Investors

List of startup investors in the BioTech, Health, and Medicine industries, along with their Twitter, LinkedIn, and email addresses.

Get the Sheet for $50 Sheet

250 FinTech Investors

List of startup investors in the FinTech industry, along with their Twitter, LinkedIn, and email addresses.

Get the Sheet for $50 1) Y Combinator Y Combinator is a leading accelerator and venture capital providing mentorship and funding to companies across all sectors.

Details of the VC firm:

Country: USA City: Mountain View Started in: 2005 Founders: Jessica Livingston, Lucas Thomaz, Paul Graham, Raffaele Colella, Robert Morris, Trevor Blackwell Industries: Enterprise, SaaS, Big Data & Analytics, Productivity, DTC, Cybersecurity, Supply Chain & Logistics, Education, Consumer, Food & Beverage, Gaming, Future of Work, Social, Transportation, Travel & Hospitality, AR & VR, Healthcare, Health & Wellness, Biotech, Fintech, InsurTech, Industrial, Aerospace & Space, Climate & Sustainability, Robotics, Government Technology, Manufacturing, Infrastructure, Legal, Marketing, Agriculture, Automative, Energy Stages: Seed, Early Stage, Pre-Seed, Series A Minimum check size: $500,000 Number of investments: 4469 Number of exits: 444 3 remarkable investments: Coinbase, Twitch, Reddit You can find their website here

You can send them an email at info@ycombinator.com

2) Techstars Techstars is a global accelerator and early-stage investor since 2006.

Details of the VC firm:

Country: Israel, USA, India, China City: San Francisco, Mumbai, Hong Kong, Shanghai, Herẕliyya, New York Started in: 1989 Founders: Samuel Isaly Industries: Advertising, Aerospace & Space, Agriculture, AI & ML, Biotech, Crypto & Blockchain, Climate & Sustainability, Cloud, Consumer, Cybersecurity, SaaS, Big Data & Analytics, Developer Tools, E-Commerce, Education, Energy, Enterprise, Entertainment, Fintech, Sports, Food & Beverage, Future of Work, Gaming, Government Technology, Hardware, Health & Wellness, Healthcare, Human Resources, Infrastructure, Legal, IoT, Life Sciences, Manufacturing, Marketplace, Media, Mobility, Productivity, Proptech & Real Estate, Robotics, Marketing, Supply Chain & Logistics, Transportation, AR & VR, Travel & Hospitality Stages: Pre-Seed, Seed Minimum check size: $20,000 Maximum check size: $100,000 Number of investments: 4116 Number of exits: 951 Funds raised: $108,000,000 3 remarkable investments: Rootine, Packworks, Payymnt You can find their website here

You can send them an email at help@techstars.com

3) RRE Ventures RRE Ventures is an American-based early-stage venture capital firm investing in tomorrow's innovation.

Details of the VC firm:

Country: USA City: New York Started in: 1994 Founders: James Robinson, Jim Robinson, Stuart Ellman Industries: Healthcare, Robotics, Proptech & Real Estate, Media, Consumer, Enterprise, Fintech, Crypto & Blockchain, Aerospace & Space, Climate & Sustainability Stages: Series A, Seed Minimum check size: $250,000 Maximum check size: $10,000,000 Number of investments: 586 Number of exits: 120 Funds raised: $1,900,000,000 3 remarkable investments: Datadog, Giphy, Buzzfeed You can find their website here

You can send them an email at info@rre.com

4) BDC Venture Capital BDC Venture Capital is one of Canada's most active VC firms with themed funds to support startups across multiple sectors.

Details of the VC firm:

Country: Canada, USA City: Montréal, Wakefield, Worcester, Bedford, Hartford, Portland, Providence Started in: 1975 Industries: Healthcare, Climate & Sustainability, AI & ML, Robotics, Food & Beverage, Industrial, Supply Chain & Logistics, Proptech & Real Estate, Aerospace & Space, Cloud, Enterprise, IoT, Cybersecurity, Big Data & Analytics, SaaS, Manufacturing, Energy, Agriculture Stages: Late Stage, Early Stage, Seed, Series A, Series B Number of investments: 509 Number of exits: 117 Funds raised: $605,000,000 3 remarkable investments: Wave, Zymeworks, Finn AI You can find their website here

5) Data Collective DCVC is a deep tech venture capital investing in seed, series A, and growth stage companies based in the US.

Details of the VC firm:

Country: USA City: Palo Alto, San Francisco Started in: 2011 Founders: Matt Ocko, Zack Bogue Industries: Climate & Sustainability, Crypto & Blockchain, Cybersecurity, Aerospace & Space, AI & ML, Deep Tech & Hard Science, Enterprise, Healthcare, Industrial, Agriculture Stages: Seed, Series A Number of investments: 469 Number of exits: 135 Funds raised: $725,000,000 3 remarkable investments: Unlearn, Helixnano, Auron Therapeutic You can find their website here

6) Lux Capital Lux Capital invests in companies at the intersection between science and technology.

Details of the VC firm:

Country: USA City: New York Started in: 2000 Founders: Peter Hébert Industries: Deep Tech & Hard Science, Robotics, Manufacturing, AI & ML, Biotech, Infrastructure, Energy, Fintech, Hardware, AR & VR, Transportation, Crypto & Blockchain, Aerospace & Space Stages: Seed, Early Stage Minimum check size: $100,000 Number of investments: 437 Number of exits: 66 Funds raised: $1,500,000,000 3 remarkable investments: Lumafield, Drone Racing, Novig You can find their website here

You can send them an email at info@luxcapital.com

7) BoostVC Based in California, Boost VC provides pre-seed investments to companies building the Sci-Fi future, which includes aerospace, energy, climate, robotics, crypto, biotech, virtual reality and more.

Details of the VC firm:

Country: USA City: San Mateo Started in: 2012 Founders: Adam Draper, Brayton Williams Industries: Aerospace & Space, Energy, Climate & Sustainability, Robotics, Crypto & Blockchain, Biotech, AR & VR Stages: Pre-Seed Maximum check size: $500,000 Number of investments: 423 Number of exits: 132 Funds raised: $85,200,000 3 remarkable investments: Source Energy Company, GGs.io, ImYoo You can find their website here

You can send them an email at apply@boost.vc

8) Draper VC Based in Silicon Valley, Draper Associates has been an early-stage investor in tech companies, including Hotmail and Skype.

Details of the VC firm:

Country: USA City: Silicon Valley Started in: 1985 Founders: Tim Draper Industries: Government Technology, Life Sciences, Biotech, Food & Beverage, Crypto & Blockchain, Education, Energy, Fintech, Healthcare, Mobility, Legal, Aerospace & Space Stages: Seed Number of investments: 406 Number of exits: 123 Funds raised: $230,000,000 3 remarkable investments: Phantom Neuro, UnumID, sHMOODY You can find their website here

You can send them an email at plans@draper.vc

9) Correlation Ventures Correlation Ventures is an American venture capital that co-invest in US-founded companies.

Details of the VC firm:

Country: USA City: San Francisco, San Diego, New York Started in: 2006 Founders: Trevor Kienzle, David Coats Industries: Aerospace & Space, Biotech, Consumer, Healthcare, Hardware, Energy, Fintech, Industrial, Proptech & Real Estate, SaaS Stages: Seed, Series A, Growth Minimum check size: $100,000 Maximum check size: $4,000,000 Number of investments: 190 Number of exits: 38 Funds raised: $360,000,000 3 remarkable investments: Zebit, Virsto, Upstart You can find their website here

You can send them an email at david@correlationvc.com

10) Metaplanet Metaplanet is a seed and series A investor for AI, biotech, crypto, healthcare, and transportation companies based in Estonia.

Details of the VC firm:

Country: Estonia City: Tallinn Started in: 2011 Founders: Jaan Tallinn Industries: AI & ML, Biotech, Crypto & Blockchain, Healthcare, Robotics, Aerospace & Space, Transportation Stages: Seed, Series A, Early Stage Number of investments: 153 Number of exits: 8 3 remarkable investments: Frontier Developments, Neurio Technology, Better Doctor You can find their website here

11) Eclipse Ventures Founded in 2015, Eclipse invests in companies transforming industrial processes.

Details of the VC firm:

Country: USA City: Palo Alto Started in: 2015 Founders: Lior Susan Industries: Proptech & Real Estate, Consumer, Healthcare, Industrial, Supply Chain & Logistics, Transportation, Aerospace & Space, Manufacturing, Infrastructure, Energy Stages: Early Stage Minimum check size: $3,000,000 Maximum check size: $4,000,000 Number of investments: 120 Number of exits: 18 Funds raised: $510,000,000 3 remarkable investments: ForSight Robotics, RideCo, Cheetah You can find their website here

You can send them an email at admin@eclipse.vc

12) 7 Percent Ventures With offices in US and Europe, 7percent Ventures invests in next-generation technology to transform industries in America and Europe.

Details of the VC firm:

Country: United Kingdom, USA City: London, San Francisco Started in: 2014 Founders: Andrew J Scott Industries: AI & ML, AR & VR, Robotics, Crypto & Blockchain, Aerospace & Space, SaaS, Marketplace, Fintech, Manufacturing, Healthcare, Deep Tech & Hard Science Stages: Seed, Series A, Pre-Seed, Early Stage Maximum check size: $500,000 Number of investments: 119 Number of exits: 23 Funds raised: $44,300,000 3 remarkable investments: Condense Reality, Volta, Versadex You can find their website here

13) I2BF Global Ventures I2BF Global Ventures is a New York-based venture capital firm that focuses on cleantech, biotechnology, materials science, IT and space technology sectors.

Details of the VC firm:

Country: USA City: New York Started in: 2006 Founders: Ilya Golubovich, Industries: Climate & Sustainability, Biotech, Aerospace & Space Stages: Early Stage Number of investments: 102 Number of exits: 12 You can find their website here

You can send them an email at info@i2bf.com

14) Playground Global Playground typically invests between seed to series B companies in next-gen computing, decarbonization, enterprise AI/ industrial automation, life sciences and infrastructure.

Details of the VC firm:

Country: USA City: Palo Alto Started in: 2015 Founders: Andy Rubin, Peter Barrett Industries: AI & ML, Deep Tech & Hard Science, Life Sciences, Biotech, Healthcare, Automation, Robotics, Aerospace & Space Stages: Seed, Series A, Series B, Early Stage Minimum check size: $1,000,000 Maximum check size: $20,000,000 Number of investments: 96 Number of exits: 19 Funds raised: $825,000,000 3 remarkable investments: Anjuna, Avail, Artificial You can find their website here

You can send them an email at info@playground.global

15) Seven Seven Six Seven Seven Six is a venture capital firm founded by the co-founder of Reddit, Alexis Ohanian.

Details of the VC firm:

Country: USA City: Palm Beach Gardens Started in: 2020 Founders: Alexis Ohanian Industries: Internet & Mobile, Gaming, Aerospace & Space, Creator Economy, SaaS, Fintech, Health & Wellness, Crypto & Blockchain Stages: Seed Number of investments: 78 Funds raised: $500,000,000 3 remarkable investments: Pipe, Alt, Lolli You can find their website here

You can send them an email at contact@sevensevensix

16) Lemnos Lemnos is a pre-seed and seed investor providing capital to hardware startups.

Details of the VC firm:

Country: USA City: San Francisco Started in: 2011 Founders: Helen Zelman Boniske, Jeremy Conrad Industries: Transportation, Travel & Hospitality, AI & ML, Automation, Hardware, Aerospace & Space, Supply Chain & Logistics, Food & Beverage, Robotics, Manufacturing, Energy, Construction, Agriculture Stages: Pre-Seed, Seed, Early Stage Minimum check size: $250,000 Maximum check size: $500,000 Number of investments: 73 Number of exits: 25 Funds raised: $71,900,000 3 remarkable investments: Quartz, Pico MES, Lumeo You can find their website here

You can send them an email at info@lemnoslabs.com

17) Space Capital Space Capital is an NYC-based venture capital specializing in the space economy.

Details of the VC firm:

Country: USA City: New York Started in: 2017 Founders: Chad Anderson Industries: Aerospace & Space Stages: Seed, Late Stage, Early Stage Number of investments: 70 Number of exits: 7 Funds raised: $264,000,000,000 3 remarkable investments: Violet Labs, Isotropic Systems, Rendered.ai You can find their website here

18) Enlightenment Capital Enlightenment Capital invests in middle-market companies in the aerospace, defence, government & technology (ADG&T) sectors.

Details of the VC firm:

Country: USA City: Washington, Chevy Chase Started in: 2012 Founders: Devin Talbott Industries: Government Technology, Aerospace & Space Stages: Late Stage Minimum check size: $5,000,000 Maximum check size: $25,000,000 Number of investments: 56 Number of exits: 17 Funds raised: $477,000,000 3 remarkable investments: Pixia, Cybercore Technologies, 1901 Group You can find their website here

You can send them an email at info@enlightenment-cap.com

19) Practica Capital Practica backs Baltic entrepreneurs primarily in the seed stage.

Details of the VC firm:

Country: Lithuania City: Vilnius Started in: 2011 Founders: Silvestras Tamutis Industries: Fintech, Supply Chain & Logistics, Travel & Hospitality, Healthcare, Proptech & Real Estate, Robotics, SaaS, InsurTech, Education, E-Commerce, AI & ML, Aerospace & Space, Agriculture, Advertising Stages: Seed, Series A, Growth Minimum check size: €200,000 Maximum check size: €2,000,000 Number of investments: 45 Number of exits: 10 Funds raised: €46,000,000 3 remarkable investments: Eneba, Billo, TransferGo You can find their website here

You can send them an email at info@practica.vc

20) Speciale Invest Speciale Invest prefers to invest in early-stage startups in deep tech with engineering innovation.

Details of the VC firm:

Country: India City: Chennai Started in: 2017 Founders: Vishesh Rajaram Industries: Enterprise, SaaS, Cloud, Developer Tools, Aerospace & Space, Robotics, Climate & Sustainability, Biotech, Gaming, Hardware, Deep Tech & Hard Science Stages: Early Stage, Pre-Seed, Seed Maximum check size: $1,000,000 Number of investments: 38 Number of exits: 4 Funds raised: $642,000,000 3 remarkable investments: Threado, Trainn, The ePlane You can find their website here

You can send them an email at info@specialeinvest.com

21) Angular Ventures Angular is an early-stage VC firm investing exclusively in B2B companies by providing their first checks.

Details of the VC firm:

Country: United Kingdom, Israel City: London, Tel Aviv-Yafo Started in: 2018 Founders: Gil Dibner Industries: AI & ML, Cybersecurity, Automation, SaaS, Industrial, Aerospace & Space, Fintech, Developer Tools, Infrastructure Stages: Early Stage, Seed, Pre-Seed Minimum check size: $200,000 Maximum check size: $3,000,000 Number of investments: 37 Number of exits: 1 Funds raised: $80,000,000 3 remarkable investments: Viably, Aquant, Fixefy You can find their website here

You can send them an email at info@angularventures.com

22) Movac Movac is a New Zealand's venture fund investing in tech companies from pre-series A to series C stages.

Details of the VC firm:

Country: New Zealand City: Wellington Started in: 1998 Founders: Phil Mccaw Industries: E-Commerce, Enterprise, SaaS, Deep Tech & Hard Science, Healthcare, InsurTech, Aerospace & Space Stages: Series A, Series B, Series C, Seed Maximum check size: $6,000,000 Number of investments: 35 Number of exits: 11 Funds raised: $250,000,000 3 remarkable investments: Tracplus, Mobi2Go, Timely You can find their website here

You can send them an email at fiona@movac.co.nz

23) Mountain Nazca Launched in 2014, Nazca partners with Mexican and Latin American founders.

Details of the VC firm:

Country: Mexico, USA City: Mexico City, Coral Gables Started in: 2014 Founders: Stiven Rodriguez, Mateo Jaramillo Industries: Biotech, E-Commerce, Fintech, Food & Beverage, InsurTech, Supply Chain & Logistics, Proptech & Real Estate, Aerospace & Space, Big Data & Analytics, Education, Healthcare Stages: Pre-Seed, Seed, Series A, Series B Number of investments: 33 Funds raised: $63,500,000 3 remarkable investments: Yuno, Sugo, Modak You can find their website here

24) Cortado Ventures Cortado Ventures invests across fintech, biotech, aerospace, agtech, energy tech, manufacturing and logistics sectors in Oklahoma and the midcontinent regions.

Details of the VC firm:

Country: USA City: Oklahoma City Started in: 2020 Founders: David Woods, Mike Moradi, Nathaniel Harding Industries: Fintech, Biotech, Aerospace & Space, Supply Chain & Logistics, InsurTech, Climate & Sustainability, Enterprise, Energy, Agriculture Stages: Series A, Seed, Pre-Seed Minimum check size: $200,000 Maximum check size: $500,000 Number of investments: 32 Number of exits: 0 Funds raised: $20,000,000 3 remarkable investments: Wilder Systems, Satellite, Glycologix You can find their website here

You can send them an email at investors@cortado.ventures

25) Freigeist Freigeist Capital backs European tech founders in their seed to pre-series A stages.

Details of the VC firm:

Country: Germany City: Bonn Started in: 2017 Founders: Frank Thelen Industries: Transportation, Food & Beverage, Aerospace & Space, Healthcare, Internet & Mobile, Manufacturing, Energy Stages: Early Stage, Seed Number of investments: 32 Number of exits: 7 3 remarkable investments: Lilium, Prosion, Build.One You can find their website here

You can send them an email at office@freigeist.com

26) Draper Cygnus Draper Cygnus is a technology venture capital investing from pre-seed to series A deals.

Details of the VC firm:

Country: Argentina City: Buenos Aires Started in: 2020 Founders: Diego Gonzalez Bravo, Diego Steverlynck, Ignacio Plaza, Tim Draper Industries: Deep Tech & Hard Science, Biotech, Aerospace & Space, IoT, AI & ML Stages: Seed, Early Stage, Series A Number of investments: 29 Number of exits: 3 3 remarkable investments: The Other Guys, Ring Captcha, iBillionaire You can find their website here

You can send them an email at info@cygnusvc.com

27) Overline Overline leads pre-seed and seed deals for companies in Atlanta and Southeast of the US.

Details of the VC firm:

Country: USA City: Atlanta Started in: 2020 Founders: Michael Cohn, Sean O'Brien Industries: Fintech, Proptech & Real Estate, Productivity, Marketing, Healthcare, Aerospace & Space, Food & Beverage, Crypto & Blockchain, Robotics, DTC Stages: Pre-Seed, Seed Minimum check size: $250,000 Maximum check size: $1,500,000 Number of investments: 28 Funds raised: $40,000,000 3 remarkable investments: Relay Payments, PadSplit, Soundstripe You can find their website here

28) Aera VC Aera VC is a sector-agnostic and geography-agnostic VC firm but preferentially invests in frontier and deep tech.

Details of the VC firm:

Country: New Zealand, Australia, Thailand, Hong Kong, USA City: Auckland, Sydney, Bangkok, Hong Kong, New York, Los Angeles Started in: 2017 Founders: Derek Handley, Keenan Kwok, Nick Winstone Industries: Climate & Sustainability, Deep Tech & Hard Science, Aerospace & Space, Food & Beverage Stages: Early Stage Number of investments: 21 Number of exits: 1 Funds raised: $30,000,000 3 remarkable investments: 54Gene, Aqua Cultured Foods, CabriCrete You can find their website here

You can send them an email at hello@aera.vc

29) VSquared Ventures Vsquared Ventures is a German deep tech venture capital firm investing in quantum and novel computing, green energy, robotics, AI/ML, new space, synthetic biology, and healthcare sectors.

Details of the VC firm:

Country: Germany City: Munich Started in: 2020 Founders: Herbert Mangesius, Thomas Oehl Industries: Deep Tech & Hard Science, Aerospace & Space, AI & ML, Robotics, Enterprise, SaaS Stages: Early Stage, Seed Number of investments: 20 Funds raised: €65,000,000 3 remarkable investments: Vaeridion, Micropsi Industries, Ramblr.Ai You can find their website here

You can send them an email at future@vsquared.vc

30) Type One Ventures Type One Ventures is an American venture capital investing in space tech, software, robotics, fintech, AI & ML, health and wellness.

Details of the VC firm:

Country: USA City: San Francisco Started in: 2019 Founders: Tarek Waked Industries: Aerospace & Space, Robotics, SaaS, Fintech, AI & ML, Health & Wellness Stages: Seed, Series A Number of investments: 17 Number of exits: 1 Funds raised: $34,000,000 3 remarkable investments: Lunar Outpost, Esusu, BRELYON You can find their website here

You can send them an email at tarek@typeone.vc

31) 808 Ventures 808 Ventures is a global VC firm investing across multiple sectors with offices across Europe, Australia and the US.

Details of the VC firm:

Country: USA, United Kingdom, Australia City: Perth, San Francisco, London Started in: 2016 Founders: Gary Macbeth, Art Caisse Industries: AI & ML, Robotics, SaaS, Crypto & Blockchain, Industrial, Health & Wellness, Climate & Sustainability, Aerospace & Space, Proptech & Real Estate, Fintech Stages: Seed, Series A, Growth Maximum check size: 500,000 Number of investments: 17 Number of exits: 1 3 remarkable investments: Byte Food, Rentberry, Hypoint You can find their website here

32) Oasis Capital Oasis capital is a sector-agnostic venture capital firm investing in early-stage companies in the US.

Details of the VC firm:

Country: USA City: Cambridge Started in: 2021 Founders: Ahmed Morad Industries: Marketplace, Deep Tech & Hard Science, Fintech, Aerospace & Space Stages: Early Stage, Seed Number of investments: 5 3 remarkable investments: Mavity, Exum, 8cdx You can find their website here

You can send them an email at admin@oasiscap.vc

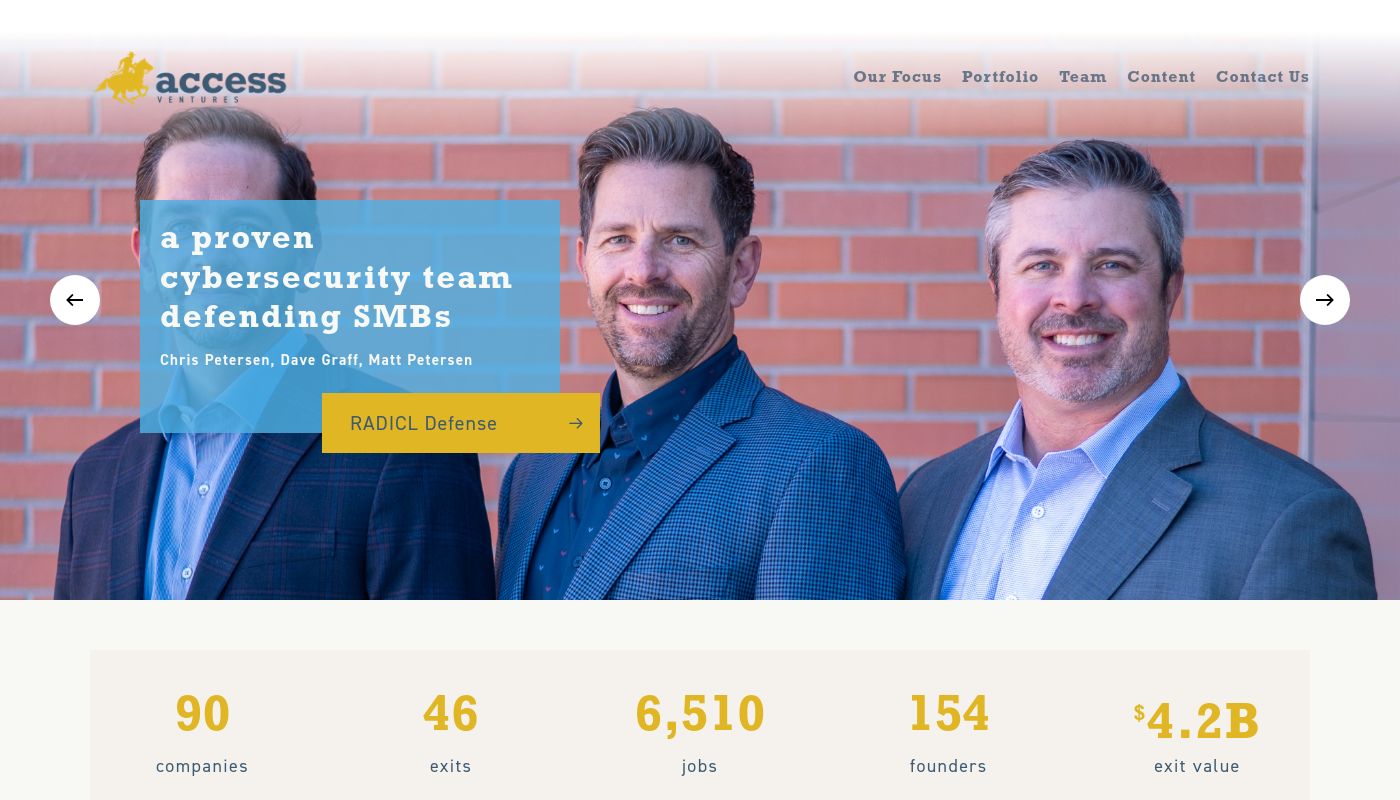

33) Access Ventures Access Ventures primarily invests in early-stage tech companies with offices in Colorado.

Details of the VC firm:

Country: USA City: Denver, Westminster Started in: 1999 Founders: Frank Mendicino III Industries: Proptech & Real Estate, Enterprise, Consumer, Cybersecurity, Human Resources, Productivity, E-Commerce, Deep Tech & Hard Science, Aerospace & Space, Automation, AI & ML Stages: Seed, Series A Minimum check size: $200,000 Maximum check size: $4,000,000 Funds raised: $65,000,000 3 remarkable investments: Alert Logic, Brightware, Innnova You can find their website here

-min.png)