The venture capital ecosystem in Brussels has undergone major growth over the last decade.

In this article, you will find some of the top venture capital firms in Brussels investing across various sectors and industries.

This free Notion document contains the best 100+ resources you need for building a successful startup, divided in 4 categories: Fundraising, People, Product, and Growth.

This free eBook goes over the 10 slides every startup pitch deck has to include, based on what we learned from analyzing 500+ pitch decks, including those from Airbnb, Uber and Spotify.

This free sheet contains 100 accelerators and incubators you can apply to today, along with information about the industries they generally invest in.

This free sheet contains 100 VC firms, with information about the countries, cities, stages, and industries they invest in, as well as their contact details.

This free sheet contains all the information about the top 100 unicorns, including their valuation, HQ's location, founded year, name of founders, funding amount and number of employees.

The venture capital ecosystem in Brussels has undergone major growth over the last decade.

In this article, you will find some of the top venture capital firms in Brussels investing across various sectors and industries.

Everything you need to raise funding for your startup, including 3,500+ investors, 7 tools, 18 templates and 3 learning resources.

Buy It For $97 $297 →

Information about the countries, cities, stages, and industries they invest in, as well as their contact details.

Get the Sheet for $50

List of 250 startup investors in the AI and Machine Learning industries, along with their Twitter, LinkedIn, and email addresses.

Get the Sheet for $50

List of startup investors in the BioTech, Health, and Medicine industries, along with their Twitter, LinkedIn, and email addresses.

Get the Sheet for $50

List of startup investors in the FinTech industry, along with their Twitter, LinkedIn, and email addresses.

Get the Sheet for $50

Enterprise Ireland is a government organisation that provides investment support and opportunities for founders looking to build their businesses in Ireland.

Details of the VC firm:

You can find their website here.

You can send them an email at equitydept@enterprise-ireland.com.

Bonsai Venture Capital has been investing in early-stage companies since 1999.

Details of the VC firm:

You can find their website here.

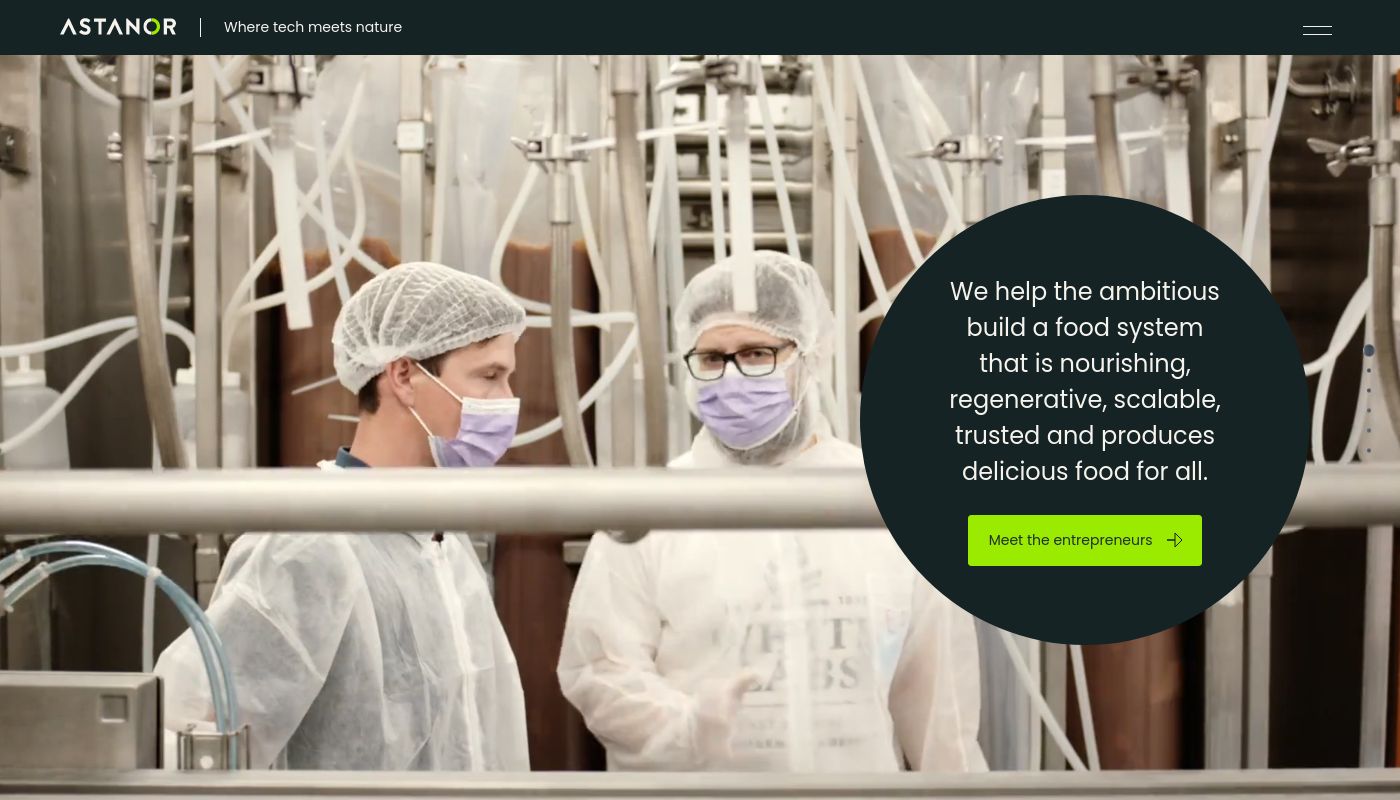

Astanor Ventures invest in founders building technology-enabled solutions to reimagine the agriculture sector.

Details of the VC firm:

You can find their website here.

Inventures Investment Partners is an impact fund for European startups.

Details of the VC firm:

You can find their website here.

You can send them an email at info@inventures.fund.

Kharis Capital invests in consumer-focused companies in Asia and Europe.

Details of the VC firm:

You can find their website here.

You can send them an email at info@khariscapital.com.

Theodorus is a Belgium seed-stage venture capital firm focusing on biotech, medtech, digital and engineering applications domains.

Details of the VC firm:

You can find their website here.

You can send them an email at info@theodorus.be.

AID Partners invests in companies within the technology, lifestyle, health tech and finance sectors.

Details of the VC firm:

You can find their website here.

You can send them an email at info@8088inc.com.

Based in Belgium, Smartfin is an investment firm exclusively investing in European B2B tech companies.

Details of the VC firm:

You can find their website here.

You can send them an email at info@smartfincapital.com.

Scale-fund is an industry-agnostic investment fund in Belgium.

Details of the VC firm:

You can find their website here.

You can send them an email at info@scale-fund.com.

Blackfin Tech is a European venture capital firm investing in late-stage fintech and insurtech companies.

Details of the VC firm:

You can find their website here.